What is Affirm?

Affirm is a credit-card alternative that allows you to pay for your order(s) over time. Affirm offers instant financing for online purchases to be paid in fixed monthly installments over 3, 6, or 12 months.

Why buy with Affirm?

- Buy and receive your purchase right away, and pay for it over several months. This payment option allows you to split the price of your purchase into fixed payment amounts that fit your monthly budget.

- If Affirm approves your loan, you'll see your loan terms before you make your purchase. See exactly how much you owe each month, the number of payments you must make, and the total amount of interest you’ll pay over the course of the loan. There are no hidden fees.

- The application process is secure and real-time. Affirm asks you for a few pieces of information. After you provide this information, Affirm notifies you of the loan amount that you’re approved for, the interest rate, and the number of months that you have to pay off your loan -- all within seconds.

- You don’t need a credit card to make a purchase. Affirm lends to the merchant directly on your behalf.

- You may be eligible for Affirm financing even if you don’t have an extensive credit history. Affirm bases its loan decision not only on your credit score, but also on several other data points about you.

- Affirm reminds you by email and SMS before your upcoming payment is due. Enable Autopay to schedule automatic monthly payments on your loan.

Who is eligible to use Affirm?

To sign up for Affirm, you must:

- Be 18 years or older (19 years or older in Alabama or if you're a ward of the state in Nebraska).

- Not be a resident of Iowa (IA) or West Virginia (WV).

- Provide a valid U.S. or APO/FPO/DPO home address.

- Provide a valid U.S. mobile or VoIP number and agree to receive SMS text messages. The phone account must be registered in your name.

- Provide your full name, email address, date of birth, and the last 4 digits of your social security number to help us verify your identity.

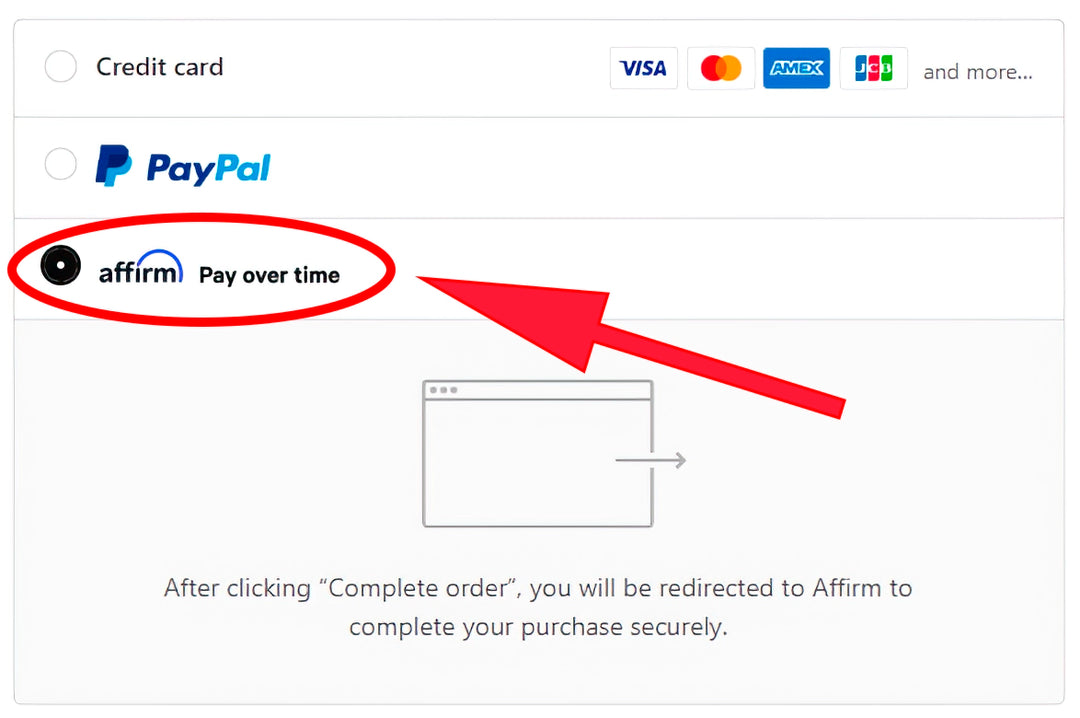

How do I pay with Affirm?

Simply select Affirm as the payment method when you are checking out. You will then be able to select your payment plan after you have been directed to Affirm’s website. Affirm accepts payment by debit card, bank transfer, and check.

How does Affirm work?

Affirm loan-application process steps:

- After adding items to your shopping cart, proceed to check out and choose Pay with Affirm.

- Affirm prompts you to enter a few pieces of information: Name, email, mobile phone number, date of birth, and the last four digits of your social security number. This information must be consistent and your own. All sensitive information is safely encrypted and protected using standard security protocols.

- To ensure that you're the person making the purchase, Affirm sends a text message to your cell phone with a unique authorization code.

- Enter the authorization code into the application form. Within a few seconds, Affirm notifies you of the loan amount you're approved for, the interest rate, and the number of months you have to pay off your loan. You have the option to pay off your loan over three, six, or twelve months. Affirm states the amount of your fixed, monthly payments and the total amount of interest you'll pay over the course of the loan.

- To accept Affirm's financing offer, click Confirm Loan and you're done.

After your purchase, you'll receive monthly email and SMS reminders about your upcoming payments. You can also set up autopay to avoid missing a payment. Your first monthly payment is due 30 days from the date that we (the merchant) processes your order.

Frequently Asked Questions

Payments on your Affirm loan are made directly to Affirm. Before each payment is due, Affirm will send you reminders via email and SMS that will include the installment amount that is due and the due date. You can also sign up for Autopay.

You can pay your Affirm bills online, by credit or ACH transfer, and sign up for autopayment at www.affirm.com/pay. Please allow 3 to 5 business days for ACH transfers to be reflected on your Affirm account. To pay by check, please follow the instructions at www.affirm.com/pay.

Yes, you can pay off your Affirm loan early. If you pay off your entire loan before the final due date, you will pay interest only for the period that you borrowed the money. Affirm rebates any unearned portion of the finance charge for the remaining loan period. To see the total pay-off amount, please go to your Affirm account and click on ‘Make Payment’.

Yes, it does. When you first sign up for Affirm, it will perform a ‘soft’ credit check to determine your eligibility for financing. This ‘soft’ credit check will not affect your credit score.

Affirm tries hard to approve every purchase but sometimes cannot approve the full amount. When this happens, Affirm will provide a debit card down payment option so that you may still complete your purchase right away.

Affirm sometimes needs more information about your financial situation to evaluate your loan application. They may ask you to link your online checking account, which helps determine your ability to repay a loan. If you are prompted to link your checking account and would like to continue with the application process, you may link your account by providing the login information for your online bank account. Affirm does not store your online banking login information - they simply pass your login credentials to your bank via a secure service linking your checking account. Linking your checking account DOES NOT authorize Affirm to debit your account. It only allows them to determine your ability to pay.

Your loan will be in a ‘Merchant Processing Order’ state while we are finalizing your purchase. To view the status of your Affirm loan(s), please visit your Affirm account at www.affirm.com/account.

If Affirm asks you to link your checking account, Affirm will not be able to offer you credit if:

- Your bank is not listed

- You choose not to link your checking account

- You don’t use online banking

- The username and/or password you provide is incorrect

- You’re unable to successfully connect your checking account

For questions about your Affirm loan, please contact Affirm by emailing help@affirm.com or by calling (855) 423-3729.

For more information on Affirm, please visit www.affirm.com/faqs.

Try it out for yourself below:

Terms And Conditions (T&C)

- The Affirm services are only available for United States residents or citizens (except for Iowa and West Virginia residents) that are 18 years or older with an SSN (Social Security Number).

- Customers are recommended to undergo prequalification prior to using the Affirm services.

- The Affirm services cannot be applied on pre-order or backorder items.

- Gift Cards cannot be purchased by Affirm.

- The Affirm services can only be used on orders worth $50 or above (shipping included).

- The billing address must be the same as the shipping address if Affirm is used as the payment method.

- Store credits or reward points cannot be used together with Affirm.

- Once the checkout is completed and the purchase with Affirm is confirmed, your purchase will be sent to us for processing.

- The order cannot be edited after you have confirmed your loan. If you want to add items to your order, another loan with Affirm shall be applied. You could also settle the orders with another payment method.

- After confirming the loan from Affirm, the first installment will start 1 calendar month from the purchase date.

- No late fees, service fees, prepayment fees, or any other hidden fees will be charged.

- Complaints or disputes about Affirm’s Services related to the origination, terms, or servicing of any credit provided by Affirm shall be directed to Affirm for resolution directly at help@affirm.com.

Return Policy for orders using the Affirm Services

If you would like a full refund on your purchase, you will have to contact us directly within 30 days from the date of purchase. Full details of the return policy can be found here.

We will only issue/initiate a refund if we receive your returned items. Affirm will credit any loan payments you have made, not including paid interest, to the original form of payment within 3 to 10 business days. If you would like to make a partial refund, Affirm will first credit the final monthly bill of your loan. If the refund amount is higher than the final monthly bill amount, Affirm will apply the remainder of the refund to the preceding month, and so on.

All other payment amounts will not change from the original terms. Please contact us if you are to cancel the order before receiving the item(s). After we have agreed to cancel your order, if your Affirm’s loan is still in a ‘processing’ state, the loan will automatically be removed from your Affirm account.